For some of you out there, you might be bummed that QuickBooks for Mac (2012 and earlier) doesn't offer a manual method to process payroll. But there's still a way you can track payroll expenses and liabilities and generate paychecks for your. Next, access Help Quickbooks Help (F1 shortcut command). From here, choose Search enter “manual payroll” Enter. This should bring up a new page featuring manual payroll and various topics. Choose the topic titled “Calculate payroll taxes manually (without a subscription to Quickbooks Payroll)”. While there are a variety of payroll options for QuickBooks desktop users from not only Intuit, but other payroll providers, I am happy to say that the 'manual payroll' option is still available within the desktop software if you simply follow my 12-steps and then take the responsibility of doing payroll correctly the manual way. Set up manual payroll in QuickBooks pro 2019 - QuickBooks Desktop 2019. There are many payroll option for QuickBooks Pro 2019. QuickBooks provide different l.

Manual payroll

There is an alternative to QuickBooks Payroll Subscriptions, it's called 'Manual Payroll'.

Intuit recently announced that their most popular payroll subscriptions are going up in cost. This increase in cost will not only impact QuickBooks users, but also ProAdvisors who either provide payroll services directly to clients, or assist clients with QuickBooks Payroll. As QuickBooks payroll subscription prices rise, fewer small businesses may decide to move ahead with automating their payroll, they will simply hang-on to those paper tax tables they have been using for the last few years and continue with their manual ways of doing payroll.

While QuickBooks ProAdvisors’ spend a lot of time teaching our clients how to use QuickBooks Payroll services, of one type or another, not many of us even bother to let our clients know that there is an ‘old fashioned’ alternative to Intuit payroll offerings. While many small businesses want to automate payroll within their accounting, many cannot afford a payroll subscription, especially in light of other payroll related costs. This article is intended to insure that readers are aware that you can still prepare payroll manually inside of QuickBooks.

A large number of mom-n-pop businesses who are starting to grow have been preparing payroll for their few employees using the old fashioned method of looking up tax tables to process payroll deductions and then hand-write or type paychecks. While this may not be the best approach it is still an alternative; however, QuickBooks stopped featuring this ‘built-in’ functionality years ago in favor of promoting payroll subscriptions. But while ‘manual payroll’ is not simply a select it option in the payroll preferences it is still and option both you and your clients should be aware of.

If a client doesn’t want to subscribe to a QuickBooks Payroll subscription, their QuickBooks can still be set-up to allow them to process manual payroll. To turn on ‘manual payroll’:

Step 1 - Click Help on the QuickBooks bar, the select QuickBooks Help.

Step 2 - Search for the manual setup article by typing calculate payroll manually,

Step 3 - Help will display a series of payroll topics:

- Click on the topic Calculating payroll taxes manually (without a subscription to QuickBooks Payroll).

Step 4 - Help opens the topic window, read the information thoroughly, including the disclosure where Intuit is telling you that if you use manual payroll processing they assume no liability for any improper calculations. [Note: if you have been preparing payroll from tax tables since your first employee you were already assuming all the liability for doing so.]

Suklam baradharam vishnum mp3 song free downloadunbound. Listen to Raj Kumar Bharathi Shuklam Baradharam Vishnum MP3 song. Shuklam Baradharam Vishnum song from the album Varasiddhi Vinaayaka is released on Aug 2014. The duration of song is 05:27. This song is sung by Raj Kumar Bharathi.

Step 5 - Near the end of the displayed information, you will find a one sentence paragraph that reads “Set your company file to use the manual payroll calculations setting.”

- Click on the words manual payroll calculations (this links you to yet another Help window).

Step 6 - This new help-window displays an additional message asking “are you sure you want to set your company file to use manual calculations?” There is some more verbiage on the screen that is intended to make you think twice about not subscribing to an Intuit Payroll Service.

- At the very bottom of this window you will see, click here: Set my company file to use manual calculations. If you wish to continue you must click on those words to proceed.

Step 7 - QuickBooks then displays the message shown in the title of this article. “You must now calculate and enter your paycheck amounts manually. If you currently have an active QuickBooks Payroll Service Subscription, you must call the Intuit Payroll Service to cancel your subscription and avoid future charges.” (Once again it seems to be all about payroll subscription revenues.)

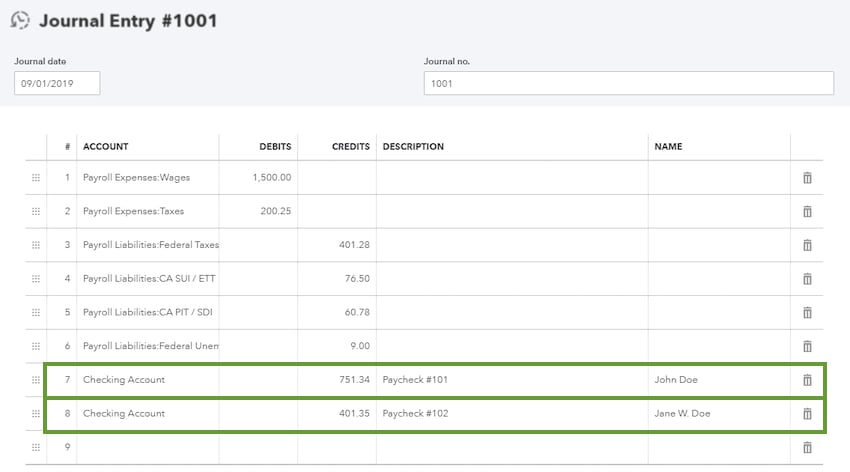

Step 8 - Manual payroll processing is now active. You will find that ‘Payroll items’ have been added to the List Menu, and you have access to the same type of payroll item functionality that payroll subscription users make use of, with the exception that all ‘figures’ such as tax rates must be entered by you.

Step 9 - Payroll checks and other payroll functionality that had been turned off in your QuickBooks file are now available.

Step 10 - You can set-up your payroll items, employees and process payroll and payroll taxes in exactly the same way you would if you had a payroll subscription with one exception, you must calculate all taxes manually (using either manual tax tables or tax formulas).

Manual Payroll Quickbooks Mac 2015 Tutorial

- In some cases payroll tax items will generally remain constant, such as the rate for Medicare and Social Security. (Check you tax tables for current rates.)

- In other cases you will need to ‘compute’ (with paper tax tables or formulas) the tax to be applied when processing the paycheck, such as Federal Withholding.

Step 11 Download 3d album 3.32 full crackfreephotography. - Just remember you are on your own, exactly like you were when you hand wrote paychecks with the only difference being that QuickBooks is posting and tracking the data you enter.

Step 12 - Unfortunately you cannot prepare or print payroll tax forms using ‘manual payroll’; however, you can easily find the information, within QuickBooks Payroll reports, you need to prepare those filings manually or enter in an on-line reporting system such as EFTPS (Electronic Federal Tax Payment System).

It is hard to truly judge the value of the manual payroll option over a subscription; for larger businesses one can expect that a payroll subscription will almost certainly be more cost effective than the task of having to use tax table look-up for each payroll as required by this process. On the other hand, for a small one or two man shop, this option may just be the alternative that their small business needs, especially if their paychecks tend to remain constant from one pay period to the next. In these cases you as a QuickBooks ProAdvisor can provide a meaningful service to your client by insuring that they are aware of this 'manual payroll' alternative which remains as 'hush hush' as QuickBooks can keep it.

To fully integrate ClockShark with QuickBooks Desktop you must have some kind of payroll enabled. You can purchase a subscription from Intuit if you would like, but if you want to use the free manual payroll option instead, you have to correctly enable it in QuickBooks. There are two different ways to go about this. One is a simple set up that will easily get you integrated, but you will not have the ability to manage all your payroll items. There is also a more in depth method that will let you manage your payroll items and make any changes to them if you need to. If you want the simple set up, start at step #1. For full control of the payroll items, start at step #6.

Simple Setup

1. In order for ClockShark to complete the integration with QuickBooks and be able to send time over from ClockShark you need at least one payroll item. Luckily, in QuickBooks there is a very quick and easy way to add one. To start, head over to Employees > Employee Centerin QuickBooks.

4.3 related ratesap calculus. 2. Double click an existing employee to edit them or add a new one. Then click on the Payroll Info tab. 💰

3. For the earnings, click on the line and select 'Add New'. ➕

4. Here we can just add a placeholder that will let ClockShark see that there is a payroll item setup. For our example we chose the options of Hourly Wages, Regular Pay, and named it 'ClockShark Default' with a rate of $0.00.

5. Also be sure that each employee has the 'Use time data to create paychecks' option enabled. Then continue with the ClockShark integration and you should see 'ClockShark Default' come up in the last step as an option! 👌

Fully Enabled Method

6. In QuickBooks go to Help > QuickBooks Desktop Help 💻

You need the correct help menu in order to enable manual payroll. If your help menu looks like this then you need to access the old help menu.

7. In order to do this, you have to disable your internet. The easiest way to do this is to click on your wifi/ethernet in the bottom right corner and select “Network & Internet settings.” Then click on “Change adapter options”. Right click on either your wifi or ethernet, and select “disable.” 🔌📶❌

8. Now that the internet is disabled, go back to Help > QuickBooks Desktop Help and your help menu should now look like this. ✅

9. Search for “Enable manual payroll” and click on “Process payroll manually (without a subscription to QuickBooks Desktop Payroll)”.

10. A new help article will pop up and you can then select “manual payroll calculations”.

11. Lastly, click on “Set my company files to use manual calculations”. 👍 😃

Manual Payroll Quickbooks Mac

12. Congratulations! QuickBooks now has the manual payroll option enabled and you can turn your internet back on and watch Netflix again! 🎥 🎬

13. You can make sure it is set up correctly by going to Lists > Payroll Item List. Here you can create payroll items to connect in ClockShark. 🕐 🦈

If you have any questions along the way please feel free to contact our Support team and get ready for answers! 🏆